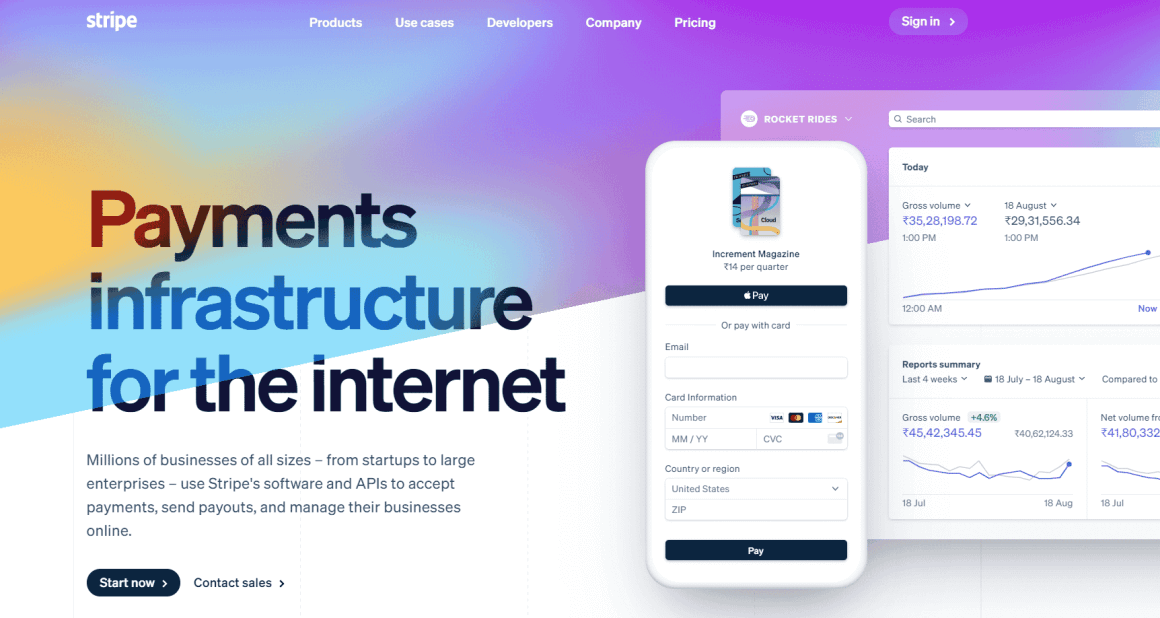

Stripe has long been a favorite payment processing platform, offering businesses of all sizes a way to easily receive and manage payments online. Over time, it has evolved into a robust payment gateway with features like auto card updates and smart retries, helping businesses streamline their operations. However, while Stripe offers many benefits, it isn’t a perfect fit for everyone, especially for entrepreneurs and small business owners with unique needs.

No single payment processor can meet the needs of every business. Stripe’s complexity and limitations can hinder growth, and that’s why exploring Stripe alternatives is essential.

In this article, we’ll dive into the 10 best Stripe alternatives available in 2024, ideal for entrepreneurs and small businesses looking for more tailored solutions.

Why You Should Consider Alternatives to Stripe

While

1. Stripe’s Ecosystem Can Be Overly Complex

Stripe is just one layer in your payment infrastructure. For complete payment processing, you’ll often need to integrate other tools for taxes, invoicing, subscriptions, and reporting. As your business grows, managing these integrations can become time-consuming and costly. Additionally, Stripe’s exclusion of popular payment methods like PayPal can limit options for your customers.

2. Potential Bottlenecks for Growth

As your business scales, the need for streamlined payment processes becomes more critical. Stripe’s limitations in handling growth opportunities can slow down or even block revenue streams, especially when multiple integrations and tools are involved. This can be a major hindrance for small businesses that need agility and fast responses to new opportunities.

3. Tax Management Complexity

Stripe isn’t always well-suited for handling complex tax regulations, especially for businesses selling internationally. The burden of managing sales tax compliance can be overwhelming, especially for small business owners who need to focus on scaling their operations. It’s crucial to have a payment processor that can simplify tax management and help you stay compliant across borders.

Top 10 Stripe Alternatives in 2024

Now that we’ve discussed some of the challenges small businesses might face with Stripe, let’s explore 10 Stripe alternatives that can offer more flexibility, ease of use, and business-specific features.

Wise

Wise (formerly Transferwise) is a standout option for businesses handling international payments. With affordable exchange rates and multi-currency support, Wise allows entrepreneurs to pay invoices and receive payments from clients around the world without the high fees typically associated with foreign transactions. For…